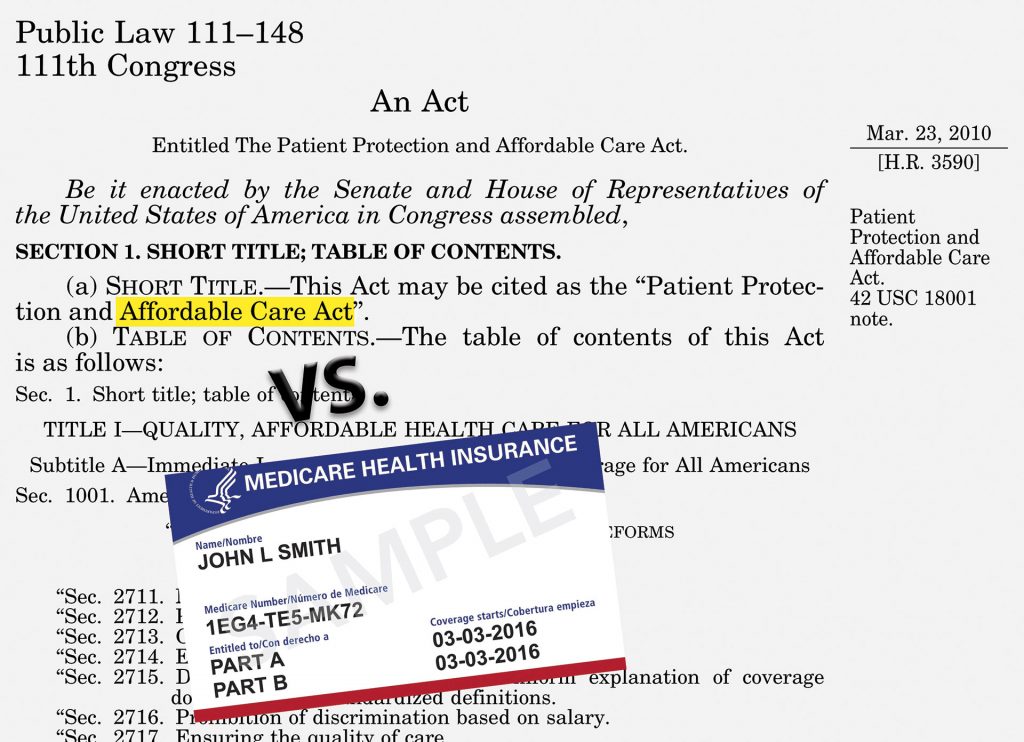

Many people are asking what the major differences are between the Affordable Care Act (ACA) also known as Obamacare or Employer-sponsored health insurance compared to Medicare. Although there are many differences between the two approaches to health insurance, in general, plans that conform to the ACA requirements and/or employer-sponsored health insurance are more generous in benefits compared to Medicare.

In the ACA vs. Medicare benefit comparison, a noteworthy point of reference is that the 10 Essential Health Benefits (EHB) applicable to the ACA and many employer-sponsored plans, are not required to be covered under Medicare. The essential health benefits under ACA set a minimum standard of required coverage for many employer-sponsored plans. In contrast, Medicare was originally created in 1965 as primarily a hospitalization benefit for seniors over age 65. In the years since, it has expanded to include some disabled persons. Overall, it does not provide all of the comprehensive benefits one typically finds in an employer-sponsored plan. However, through the years, Medicare has expanded its coverage to include preventive services similar to the types of preventive care offered in employer-sponsored coverage.

Another key difference between ACA/Employer-sponsored plans and Medicare is that ACA and employer-sponsored coverage includes a cap on the amount of money a plan participant could be responsible for in any particular calendar year. This feature, called an out-of-pocket maximum, helps protect against unending medical expenses. Once a plan participant has spent the amount of money equal to the out-of-pocket maximum for covered medical care, then for the remainder of the calendar year, all future costs for covered services are paid by the health plan—the plan participant no longer needs to pay any copays or coinsurance. At that point, the plan become a 100% plan, meaning that the health plan pays 100% for remaining covered services for the calendar year. In contrast, Medicare does not contain an out-of-pocket maximum, which means that if a participant were to have a catastrophic accident or serious, chronic medical condition, the Medicare plan does not have a cap on the amount of money a participant would need to pay. Therefore, the financial risk to a participant is greater under a Medicare plan compared to an ACA or employer-sponsored plan.

The Affordable Care Act (ACA) also provided additional consumer protections to health insurance which do not apply to Medicare. For example, in ACA plans, there are 10 categories of essential health benefits, which must be covered; whereas, in Medicare this structure of EHB does not apply. Additionally, under ACA, health plans cannot create discriminatory plan designs which limit or discourage individuals with certain medical conditions from enrolling in their plans. This nondiscrimination standard is only applicable to ACA plans— whether individual plans or small group employer-sponsored plans. Other consumer protection laws in health insurance ensure that mental health and substance use disorder benefits are offered on the same terms as medical/surgical benefits. This is known as mental health parity and it does not apply to Medicare. The ACA made great strides by requiring that a comprehensive package of benefits would be available to all individuals and small groups. Furthermore, ACA required that all plan participants’ civil rights be protected in the provision of health care—through both insurance coverage options and treatment options. The specific criteria of nondiscrimination standards applies only to ACA individual and small group employer-sponsored health insurance; it does not apply to Medicare.

Currently, there are many assaults on the protections that the ACA provides. For example, on June 14, 2019, the Department of Health and Human Services published proposed regulations in the Federal Register that would repeal many of the civil rights protections currently afforded to every person enrolled in an ACA individual or employer-sponsored small group health plan. The proposed regulations, if finalized, will strip out civil rights protections and roll-back nondiscrimination rules in health care. That means, if the proposed rule is successful, it may be permissible to discriminate in the provision of health benefits on the basis of sex, race, color, national origin, age, and disability status. These are the civil rights conferred to all through Title VI, Title IX, Section 504 and the Age Act and it is due to Section 1557 of the ACA that these civil rights apply to health care and health insurance benefits.

In summary, ACA and employer-sponsored plans provide richer benefits and more consumer protections— by limiting financial risk and providing civil rights nondiscrimination protections— compared to current Medicare.